COMFORT & CONFIDENCE FOR YOUR FINANCES

At Whitten Retirement Solutions, we provide the confidence our clients need to prepare for their financial future.

Whitten Retirement Solutions

At Whitten Retirement, we understand that you have goals that you want to accomplish now, and dreams for your future. Our mission is to make both a reality.

Our team will help you create an effective game plan, provide advice in a common language, and do it with straightforward fees. We’re here for you if you’re looking for financial advice, retirement help, or for general planning and money management.

Contact us today to learn more about how we can help.

*as recognized by a regional nomination and voting process

Blake Whitten | LPL Financial Advisor

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck

Address:411 Muse Street, Cambridge, MD 21613

Greg Whitten | Senior Financial Consultant

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck

Address: 411 Muse Street, Cambridge, MD 21613

Work With an Advisor Today

Give us a call today to learn more.

410-228-6715

Our Services

Your advisor should put your interests first, and provide strategies focused on your specific financial objectives. That’s what we do here.

Some of our services include retirement planning, IRA Management, Long-Term Care Planning, Mutual Funds, Life Insurance, and small business services.

Retirement

Investing

Business Planning

Business Owners Planning Through Their Retirement

Blake Whitten2024-02-07T14:33:05+00:00February 7, 2024|

As Goes January, So Goes the Year

Blake Whitten2024-02-05T15:22:26+00:00February 5, 2024|

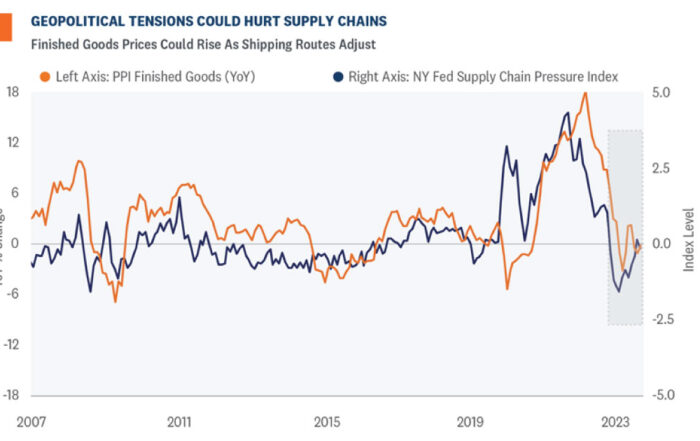

Will Shipping Disruptions Alter Fed Plans?

Blake Whitten2024-01-25T13:40:08+00:00January 25, 2024|

Alternative Investments Outlook: Embracing Agility

Blake Whitten2024-01-19T21:38:30+00:00January 19, 2024|

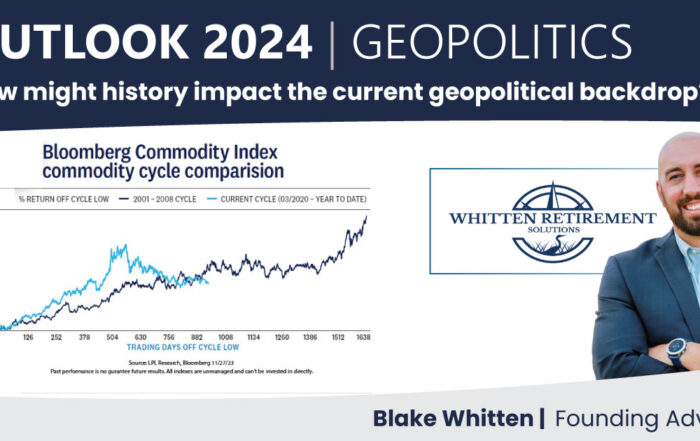

Outlook | The Geopolitics Landscape

Blake Whitten2024-01-12T20:33:55+00:00January 12, 2024|

Critical Financial Planning Steps for Business Owners

Blake Whitten2024-01-11T21:03:13+00:00January 11, 2024|

May is Military Appreciation Month, a time to recognize the dedication and sacrifices made by those who have served or currently are serving in the armed forces.

Some of the families whom we work with have a connection to the military—whether they have served themselves or have loved ones who currently are serving.

Their experiences remind us of the sacrifices made, not only by those in uniform, but also by their families.

Their commitment protects our freedoms, and their service deserves appreciation—not just this month, but every day.

Thank you to all who have served, are serving, or support those who do.

#militaryappreciationmonth #HonoringService #thankyouforyourservice

... See MoreSee Less

We are celebrating #SmallBusinessAppreciationWeek & Cinco de Mayo with one of our favorite businesses in town, Don Chuy Mexican Taqureia!

I hope you’re celebrating the day with delicious Mexican cuisine, supporting your local Mexican-owned businesses, and taking a moment to appreciate the rich history behind the holiday.

How are you celebrating? 🎉

#CincoDeMayo #CulturalCelebration

... See MoreSee Less

0 CommentsComment on Facebook

🚒 This year, it seems particularly important to recognize International Firefighters’ Day. The wildfires in California and other disasters nationwide serve as a reminder of the critical role that firefighters play in keeping communities safe. Their work is demanding and dangerous, and often goes unrecognized, yet they show up time and time again.

To all firefighters: Thank you for your service, courage, and commitment to protecting lives and livelihoods.

If you know a firefighter, please take a moment today to thank them and tag them below!

#InternationalFirefightersDay #CommunityHeroes #FirefighterAppreciation

... See MoreSee Less

0 CommentsComment on Facebook

Question: What percentage of Americans do you think feel financial stress? 💙

Answer: Most Americans! To be precise, 84% of Americans feel financial stress, according to a NerdWallet study completed in 2024.

Financial stress isn’t just about numbers—it’s a real health concern that affects people of all ages.

It can impact sleep, relationships, and overall well-being, yet it’s often something people feel they must manage alone.

May is Mental Health Awareness Month, a reminder that mental health is just as important as physical health. As financial professionals, we see firsthand how money concerns can weigh on people.

The good news?

Having a clear strategy can manage uncertainty, build confidence, and help provide a sense of control.

This month, let’s recognize the real impact financial stress can make on mental health and continue normalizing conversations around both.

What’s one way you manage financial stress?

#MentalHealthAwarenessMonth #FinancialWellBeing #MindsetMatters

... See MoreSee Less

0 CommentsComment on Facebook

How much life insurance do you need?

The answer to that can depend on many factors…

May 2 is National Life Insurance Day, a reminder to evaluate whether you’ve adjusted your insurance as your life has evolved and, ultimately, whether you feel comfortable with the amount of coverage you have.

Some key questions to consider:

🔹 What would your family do without your income?

🔹 Does your coverage reflect your current financial situation?

🔹 Have your needs changed due to life events like marriage, children, or business ownership?

For many, life insurance is about more than helping with expenses; it’s about creating a legacy, protecting a business, or looking to provide for future generations. Yet, too often, it’s put off until “later.”

A word of caution: you should consider determining whether you are insurable before implementing a strategy involving life insurance. Several factors affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

When was the last time you reviewed your coverage? Message us if you’d like to review how your life insurance fits into your financial picture.

#NationalLifeInsuranceDay #FinancialStrategies #LifeInsuranceMatters

... See MoreSee Less

0 CommentsComment on Facebook

Voting for Coastal Style Magazine's Annual Best of Readers Poll is officially open! Today through May 31st you can cast your votes for the businesses that make our community shine. Whether it be your favorite restaurant, professional, or service, now's your chance to give them the recognition they deserve!

Vote now at: coastalstylemag.com/best-of-2025/

... See MoreSee Less

0 CommentsComment on Facebook

WHY WHITTEN?

You have a lot of options for financial services and advice. Learn more about why Whitten Retirement may be the best fit for you.

0 CommentsComment on Facebook